Effective Strategies to Manage Debt While Facing Furlough

Effective Strategies to Manage Debt While Facing Furlough

The COVID-19 pandemic has had a significant impact on the UK economy, resulting in a surge of furloughs and job losses across various industries. Consequently, countless individuals are now facing financial difficulties and the stress of managing debt with a significantly reduced income. If you find yourself on furlough, receiving merely 80% of your usual salary, confronting your debt can seem daunting. Nevertheless, it is entirely feasible to navigate this difficult financial period by employing effective techniques to manage and reduce your obligations. Here, we outline actionable steps you can take to regain control of your financial health during these challenging times.

1. Create a Customized Monthly Budget Reflecting Your Current Income

Begin by developing a revised monthly budget that accurately represents your current financial situation. This budget should accommodate your reduced income while clearly outlining your ability to save. Invest some time in evaluating your spending habits and pinpointing non-essential expenditures, such as entertainment, dining out, and luxury items that can be minimized. By reallocating these funds towards essential expenses and savings, you can prioritize your financial responsibilities more effectively. This thoughtful approach not only aids in managing your debts but also equips you for any unforeseen financial challenges that may emerge in the future.

2. Identify Additional Income Sources to Offset Salary Reductions

To effectively meet your debt repayment commitments, it’s crucial to explore options for compensating your 20% salary reduction. Investigate potential income-generating opportunities, such as freelance work or part-time jobs, that can enhance your earnings. Additionally, consider reducing expenses by canceling seldom-used subscriptions or revising your grocery shopping habits. Implementing a budget-conscious meal plan can lead to substantial reductions in your monthly expenditures. By actively pursuing these additional income streams and savings initiatives, you will be better equipped to fulfill your debt obligations and avoid falling behind during your furlough period.

3. Investigate Debt Consolidation Loans for Simplified Payments

Consider the possibility of applying for debt consolidation loans for bad credit. These financial solutions can streamline your various obligations by consolidating multiple debts into a single, manageable monthly payment. This approach minimizes confusion regarding payment due dates and amounts, facilitating better financial planning. For individuals experiencing furlough, a <a href="https://limitsofstrategy.com/debt-consolidation-loan-calculator-for-effective-budgeting/">debt consolidation loan</a> can offer a structured method for managing your limited income while alleviating the stress of handling multiple payments, ultimately helping you stabilize your financial situation.

4. Align Your Financial Strategies with Long-Term Goals

While addressing your current financial challenges, it’s vital to keep your long-term goals in sight, whether they include homeownership or starting your own business. Setting these future objectives can serve as a source of motivation to enhance your financial standing. Moreover, a debt consolidation loan can improve your credit rating, making it easier to qualify for favorable mortgage or business loan rates. By planning strategically and diligently working towards your financial aspirations, you can lay the groundwork for achieving greater financial independence and success in the years to come.

If you require additional guidance and expert insights on managing your finances during the pandemic, along with understanding how debt consolidation loans can aid furloughed employees, don’t hesitate to contact Debt Consolidation Loans today.

If you are a homeowner or business owner, connect with the experts at Debt Consolidation Loans today to explore how a debt consolidation loan can bolster your financial health and stability.

If you believe a Debt Consolidation Loan aligns with your financial objectives, please reach out to us or call 0333 577 5626. Take the vital first step toward enhancing your financial situation with a single, manageable monthly payment.

Unlock Essential Financial Resources for Expert Guidance and Support:

Consolidate My Medical Loan: Is It Possible?

Consolidate My Medical Loan: Is It Possible?

Can You Successfully Consolidate Your Medical Loan?

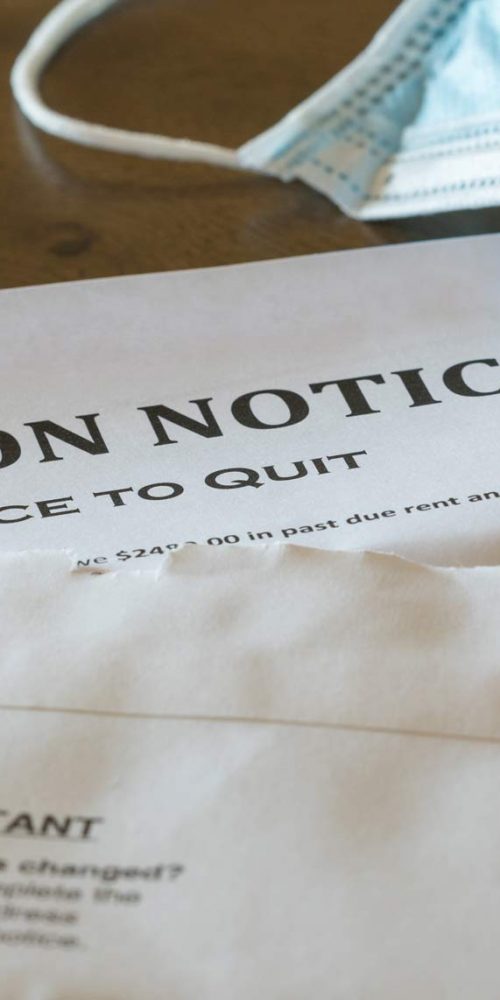

Evictions Delayed Until March, Car Seizures Still Allowed

Evictions Delayed Until March, Car Seizures Still Allowed

Evictions Delayed Until March: Crucial Information You Must Know

Get Out of Debt Quickly: Effective Strategies to Consider

Get Out of Debt Quickly: Effective Strategies to Consider

Effective Approaches to Quickly Escape Debt

Debt Consolidation Loans UK: Benefits and Drawbacks

Debt Consolidation Loans UK: Benefits and Drawbacks

Understanding the Pros and Cons of Debt Consolidation Loans in the UK

Debt Consolidation Loan Calculator for Smart Financial Planning

Debt Consolidation Loan Calculator for Smart Financial Planning

Utilize Our Debt Consolidation Loan Calculator for Effective Financial Planning

The Article Furloughed and in Debt? Key Actions You Must Take Was Found On https://limitsofstrategy.com